Gifting My Accounting Community A Blog Content Idea

Gifts aren't meant to be kept by us, but to be shared with everyone.

I am working with an app partner on some resource content for their SMB audience. I have been giving them a few ideas, and one topic that I thought was important to communicate to SMBs did not resonate with them. I had crafted the outline, and now it’s burning a hole in a Google Doc. I don’t blog or email on SMB topics, but I want this content to go out, not go to waste.

So I’m sharing the outline for you, my accounting friends and subscribers, to send out via your channels.

It’s only the outline - in point form - but it’s a pretty good start on a daily habit I wish all business owners (and individuals) would adopt.

Lift it, personalize it and share it away, friends!

Track Your Banking Activities Daily!

Why is it important to track your bank activity daily?

This is important, not just for cash flow but for security.

Helps you stay on top of your finances:

By checking your bank balance daily, you can stay informed about your financial situation and avoid overspending or overdrawing your account.

This can help you stay on top of your budget and avoid financial stress.

Avoids overdraft fees:

If you check your bank balance daily, you can ensure that you have enough funds to cover your expenses and avoid overdraft fees.

This can save you money and help you maintain a positive relationship with your bank.

Detect fraudulent activity:

Daily checking of your bank balance can help you identify suspicious transactions and alert your bank immediately.

This can prevent unauthorized access to your account and protect your finances.

Plan for upcoming expenses:

Knowing your bank balance daily allows you to plan for upcoming expenses and adjust your budget accordingly.

This can help you avoid surprises and better manage your money.

Knowing your bank balances daily can help you stay financially responsible and avoid costly mistakes.

Track your credit card and LOC accounts as well.

Credit cards are often used for seemingly inconsequential expenses that pile up:

Keep the nickel-and-dime costs from adding up to dollars.

And sometimes they are the ones that people in your organization shouldn’t be expensing!

This can easily lead to compliance issues with the IRS.

Line of Credit transactions are usually significant transactions:

These must be budgeted for, and large rogue spending can quickly lead to trouble.

Stay on Top of Your Credit Utilization:

Your credit utilization rate is the amount of credit you use compared to your credit limit. Tracking your credit card and LOC accounts can help you keep your credit utilization rate in check and avoid exceeding your credit limits.

This is important because a high credit utilization rate can negatively impact your credit score.

Prevent Fraudulent Activities:

Like bank accounts, monitoring your credit card and LOC accounts can help you detect fraudulent activities.

You can quickly identify any unauthorized transactions and report them to the credit card issuer or lender.

Avoid Late Payments:

By tracking your credit card and LOC accounts, you can ensure that you make your payments on time.

Late payments can result in fees and negatively impact your credit score.

Technology can help with this.

How do you find the time to track and manage the transactions?

Tracking transactions and monitoring your bank balance can be time-consuming if you do it manually. However, several technologies can help you automate the process and make it easier to manage your finances.

Mobile Banking Apps:

Most banks offer mobile banking apps that allow you to check your balance, view your transaction history, and set up alerts for account activity.

You can easily download these apps to your smartphone and access your account information anytime, anywhere.

Business Finance Apps:

Many business finance apps are available that can help you track your spending and your bank balance.

Payment platforms such as [INSERT YOUR FAV PAYMENT PLATFORM*] are integrated with your accounting platforms for real-time syncing of open accounts payable and payment data.

There are different levels of approval and authorization to control payments.

Accounting platforms can have multiple banks, credit cards, and LOC transaction feeds pulling activity to a consolidated view.

These apps can categorize your expenses, provide detailed spending reports, and even offer budgeting tools to help you manage your finances.

Automatic Alerts:

Most banks offer automatic alerts that can be set up to notify you of specific account activity, such as large transactions, low balances, or unusual activity.

You can receive these alerts via email, text, or the bank's mobile app.

Many technologies are available to help you track your transactions and monitor your bank balance, making it easier to manage your finances, stay on top of your financial goals, and manage fraudulent transactions.

Summary

Tracking your bank activity daily leads to better financial and security outcomes. And technology will help make it easier for you to do!

Hopefully, I gave a few of you a quicky little piece of content to share out - a nice low lift to get your message in front of your audience :-}

*I am referring to the likes of Bill/Corpay/Melio/Plooto here - pick your recommended payment app and pop it in

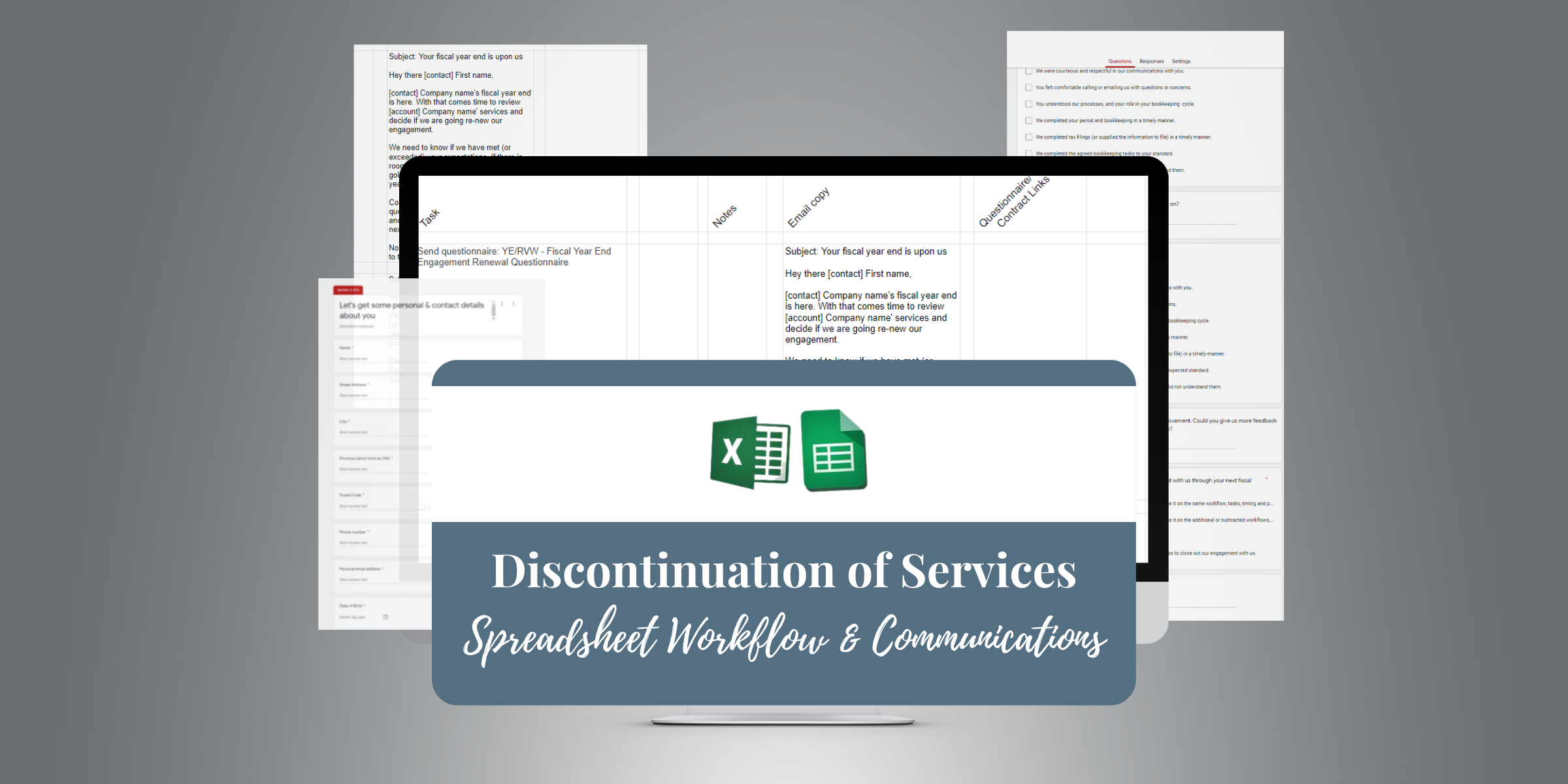

Featured Template

~~~

Featured Template ~~~

15% off discount code: BLOG

This workflow relates directly to the session I am hosting on May 17th! Details below the featured template.

The Discontinuation of Services process can be lengthy and it's easy to miss steps. Streamlining this workflow will leave your client with a great final impression, and it will save you time and energy.

It takes effort and trial and error to get the full process mapped out tightly.

Luckily for you, we’ve already done all the leg work! Created by accounting professionals, these templates make the offboarding process harmonious and efficient.

What you get:

Checklists of tasks & to-dos

Email templates

Discontinuation of Services contract template (needs to be legally vetted for your region)

How-to videos

Join Your Peers Here

- CPB Webinar Wednesdays - Graceful Endings: Disengaging Clients

Wednesday May 17, 2023

3:00 PM - 4:00 PM

It’s time to say goodbye to a client.

There are many steps to disengage a client, and you must get through them promptly and thoroughly. Dragging it out, miscommunication, repeating requests, and forgetting steps can make a messy affair out of even the most cordial ending.

This session details how to calmly disengage clients using forms, communications, processes and task lists.

*For specific accounting program disengagement tasks, only QBO-centric examples will be discussed. The task concepts can be easily adjusted for Sage and Xero by users of those programs.*

Gracefully yours, Kellie :-}

::Shameless Call To Action::

I sell bookkeeping templates, standard operating process handbooks and client guides.

15% off discount code: BLOG